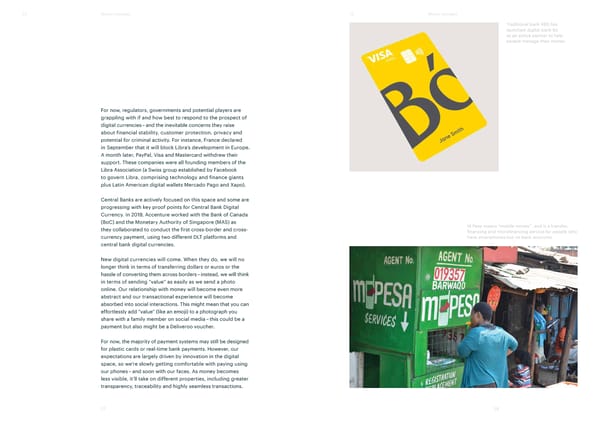

T2 Money changers T2 Money changers Traditional bank RBS has launched digital bank Bó as an active partner to help people manage their money. For now, regulators, governments and potential players are grappling with if and how best to respond to the prospect of digital currencies – and the inevitable concerns they raise about financial stability, customer protection, privacy and potential for criminal activity. For instance, France declared in September that it will block Libra’s development in Europe. A month later, PayPal, Visa and Mastercard withdrew their support. These companies were all founding members of the Libra Association (a Swiss group established by Facebook to govern Libra, comprising technology and finance giants plus Latin American digital wallets Mercado Pago and Xapo). Central Banks are actively focused on this space and some are progressing with key proof points for Central Bank Digital Currency. In 2019, Accenture worked with the Bank of Canada (BoC) and the Monetary Authority of Singapore (MAS) as M-Pesa means “mobile money”, and is a transfer, they collaborated to conduct the first cross-border and cross- financing and microfinancing service for people who currency payment, using two different DLT platforms and have smartphones but no bank accounts. central bank digital currencies. New digital currencies will come. When they do, we will no longer think in terms of transferring dollars or euros or the hassle of converting them across borders – instead, we will think in terms of sending “value” as easily as we send a photo online. Our relationship with money will become even more abstract and our transactional experience will become absorbed into social interactions. This might mean that you can effortlessly add “value” (like an emoji) to a photograph you share with a family member on social media – this could be a payment but also might be a Deliveroo voucher. For now, the majority of payment systems may still be designed for plastic cards or real-time bank payments. However, our expectations are largely driven by innovation in the digital space, so we’re slowly getting comfortable with paying using our phones – and soon with our faces. As money becomes less visible, it’ll take on different properties, including greater transparency, traceability and highly seamless transactions. 27 28

xReport Page 15 Page 17

xReport Page 15 Page 17